- 74 percent of M&A professionals expect an increase in business acquisitions over the next year, particularly in the small and mid-cap sectors, driven by lower interest rates and succession issues among family businesses.

- 64 percent foresee growth in distressed deals due to refinancing challenges, while 59 percent expect a rise in divestments as companies refocus on core strengths.

- The outlook for the IPO market in 2025 appears lukewarm, while mega-deals (over 1 billion euros) are expected to remain stable, with some optimism for a slight increase in 2025. SPACs are seen as a dying trend.

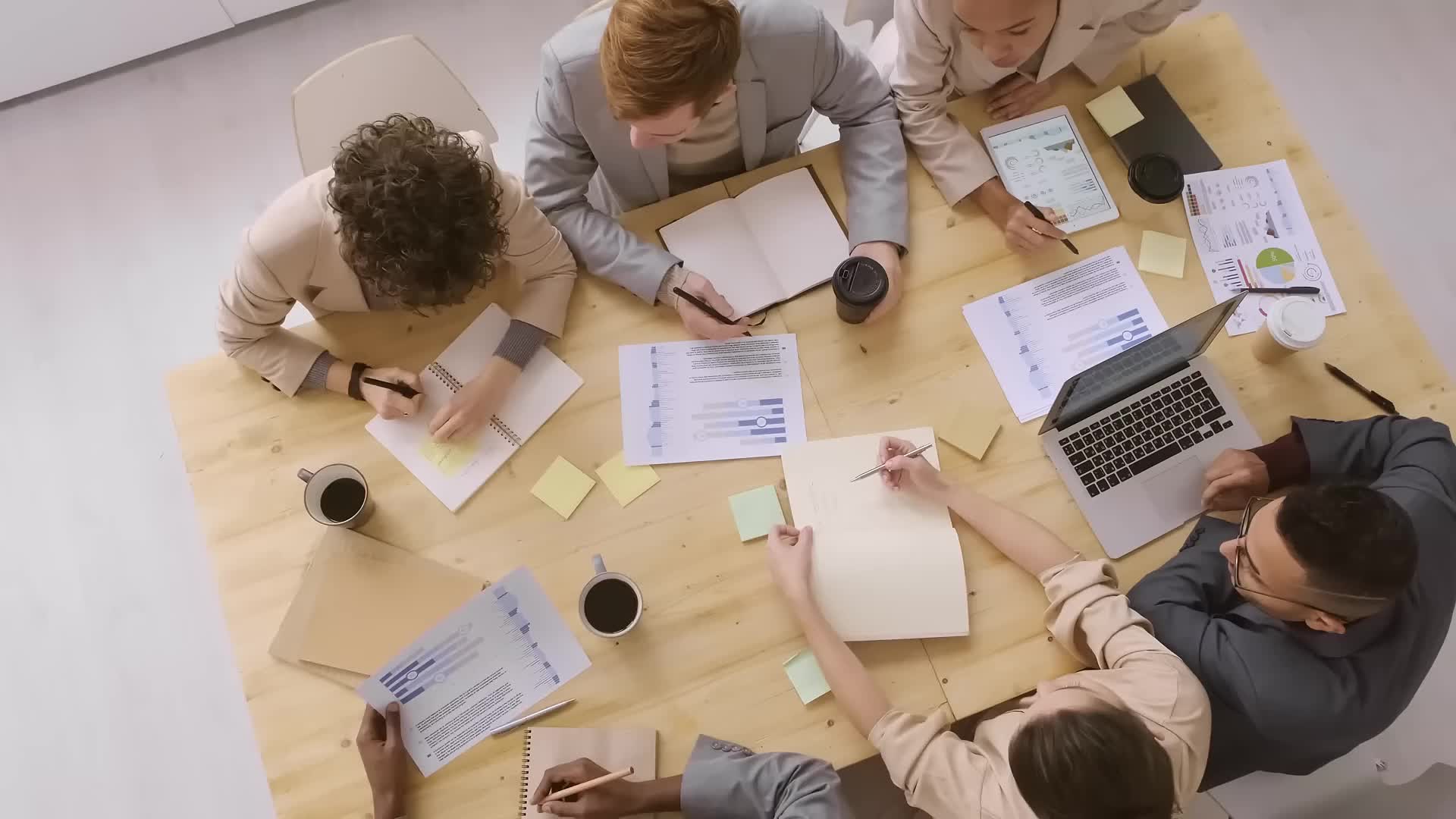

The Benelux M&A market is poised for an active year in 2025, with varying expectations across different types of corporate deal activity.

By Jeppe Kleijngeld

M&A professionals are largely optimistic about the number of business acquisitions in the next twelve months, with 74 percent anticipating an increase. Meanwhile, 21 percent expect the volume to remain roughly the same, and only 5 percent foresee a decline.

In the areas of distressed deals and divestments, a significant majority of dealmakers also predict growth, with 64 percent and 59 percent respectively expecting an increase.

However, when it comes to IPOs and mega-deals (transactions valued at 1 billion euros or more), most dealmakers believe the volume will stay relatively stable. As for SPACs, the consensus among M&A professionals and investors is that they are effectively ‘dead’.

This is evident from the M&A Trend Survey Benelux 2024 / 2025 by M&A and Ansarada. For this research, 175 Dutch and Belgian M&A professionals took part in an online survey and the M&A editors interviewed 35 dealmakers live.

We examine the 6 key areas based on insights from top Benelux dealmakers.

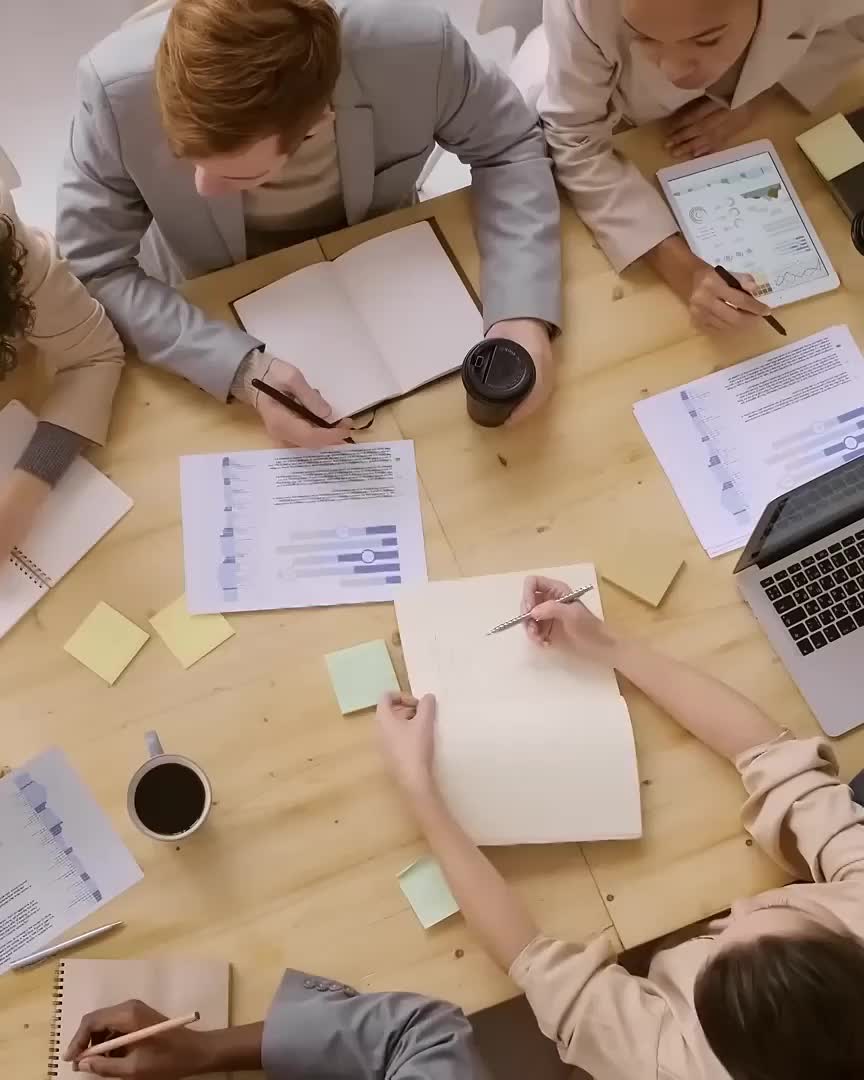

1. Business Takeovers

Business Takeovers

M&A professionals are overwhelmingly positive about the outlook for business takeovers. Tom Snijckers, Partner at Oaklins Netherlands, anticipates a significant rise, particularly in the small and mid-cap segment (up to 150 million euros). He observes: "Deals in the larger segment remain more difficult, but our pipeline shows strong activity in the smaller markets."

Tom Beltman, Managing Partner at Marktlink Mergers & Acquisitions, echoes this optimism: “We’re seeing a strong increase in mandates from entrepreneurs looking to sell. The decreasing number of family businesses, paired with their growing professionalization, is driving demand. There are both succession issues and demand for investments for growth. The banks are also participating, which is an important condition for an increase.”

“There are both succession issues and demand for investments for growth. The banks are also participating, which is an important condition for an increase.”

Tom Beltman, Marktlink Fusies & Overnames

Nancy De Beule, Partner at PwC Belgium, believes that if interest rates continue to decrease, deal volume could indeed accelerate in 2025. “Corporates remain eager to pursue acquisitions to expand their footprint and drive international growth. With plenty of cash still circulating in the market, you'd expect to see an increase in activity. However, whether that rise will be steep or moderate is yet to be seen. Inflation, along with geopolitical factors like the U.S. elections, the war in Ukraine, and the situation in the Middle East, will continue to play a role.”

Sergio Herrera, Managing Director M&A at Rabobank, believes a turning point is near: “With lower interest rates on the horizon, cheaper capital will become more accessible. This will be the first 'normal' year after COVID and the Ukraine conflict, which should boost deal-making confidence.”

2. Distressed Mergers and Acquisitions

Bijschrift grafiek

Despite expectations from dealmakers and restructuring teams for a rise in distressed deals in the past two years (in last year's trend survey, 81 percent expected an increase), the reality has shown very little distressed M&A activity. Why is that? “Most large companies that run into trouble are being supported by shareholders and banks", explains Jan-Hendrik Horsmeier, Partner at Clifford Chance. “This allows them to stay afloat. However, smaller retailers or fashion brands have faced significant difficulties. High street retail is still struggling, but these are generally smaller companies with very thin margins."

Although distressed activity has been limited in recent years, the majority of dealmakers (64 percent) still anticipate an increase in 2025. “We’re already seeing distressed activity ramping up towards the end of 2024, and it’s expected to stabilize in 2025", says Peter Zwijnenburg, Managing Director EMEA/Benelux at Aon M&A and Transaction Solutions. “This is partly driven by refinancing challenges, as equity holders are either unable or unwilling to make additional contributions.”

"Distressed M&A is bound to rise", predicts Philippe Craninx, Managing Partner at Moore Corporate Finance. “There are two main factors at play. First, several sectors are struggling, particularly retail and construction. Second, over the past five to ten years, banks have increasingly moved towards covenant-based financing. Covenant breaches are far more common today than they were a decade ago."

Sander Neeteson, Head of Corporate Finance at ABN AMRO, also foresees a modest increase in distressed mergers and acquisitions. “This is largely due to refinancing challenges. Many companies are overleveraged, having borrowed heavily at low interest rates, and now face the need to refinance at higher rates. As a result, they often encounter a 'refinancing wall’. This issue is further compounded by banks' reluctance to lend, as they are required to maintain higher capital buffers under the Basel 4 regulations.”

3. Divestments

Bijschrift grafiek

Divestments are expected to see significant growth in the coming year, with the majority of dealmakers (59 percent) anticipating an uptick in activity. In last year's trend survey, this was 55 percent. This trend is driven by several factors, including succession issues and the ongoing move toward specialization and consolidation. "The current generation of shareholders is increasingly younger when they sell", says Tom Snijckers, Partner at Oaklins Netherlands. "We also see a continued trend of companies focusing on their core strengths, leading to more divestments."

"The current generation of shareholders is increasingly younger when they sell. We also see a continued trend of companies focusing on their core strengths, leading to more divestments."

Tom Snijckers, Oaklins Netherlands

For some sectors, divestments may be a strategic response to financial pressures. "Struggling companies will eventually need to find solutions, which often means selling off parts of the business", explains Franck Marra, Partner at Pontex Investment Partners. This can take the form of acquisitions or restructuring efforts aimed at survival.

Kuif Klein Wassink and Ico Jalink, Partners at Dentons, echo this sentiment, noting that divestments and carve-outs are likely to continue, driven in part by interest from private equity. "Successful examples in the past and ongoing demand from private equity players ensure that divestments remain strong." They point to notable divestments they were involved in, such as the carve-outs of Celavita and Europastry, both companies with activities that no longer fit well with that of the American parent company.

However, some experts expect the pace of divestments to remain steady rather than surge. "Divestments and carve-outs are always on the table e.g. as a way to unlock value or to increase focus on key activities, whereby activists may push for this with publicly listed companies (both behind the scenes as well as in the public eye)", says Marc Habermehl, Partner at Stibbe. "I don’t foresee a massive increase in activity on these transactions and we’ll likely see a steady stream of carve-out transactions, rather than a significant spike."

4. IPO's

The outlook for the IPO market in 2025 appears lukewarm, as revealed by the M&A Trend Survey Benelux by M&A and Ansarada. A modest 19 percent of dealmakers expect an increase in activity (last years this was 33 percent), while 26 percent foresee a decline, and a majority, 55 percent, anticipate no significant change in volume.

Sergio Herrera, Managing Director of Rabobank's M&A team, suggests that while IPOs may eventually pick up, it will take time. "It’s still thin, but we might see momentum later next year. A few successful IPOs could be the catalyst to reopen the market." This cautious optimism is shared by other experts. Niek Kolkman, Head of Deals at KPMG, notes that "the number of IPOs is likely to increase as the stock market environment improves", while Hossein Araghi from Lyvia Group sees potential in the current low activity, stating, "IPOs are now at an all-time low. The only way they can go is up."

However, the market remains challenging. Kuif Klein Wassink and Ico Jalink, Partners at Dentons, point out that "a slight increase is expected for IPOs, but it's simply not a 'hot market.'" Meanwhile, Jan-Hendrik Horsmeier, Partner at Clifford Chance, believes that any increase is gradual: "We're slowly seeing more activity, but an increase from zero is quite easy. More companies may even leave the stock exchange than enter it this year."

Tom Beltman, Managing Partner at Marktlink Fusies & Overnames, sees IPOs as a crucial pathway for larger deals. "For larger transactions, IPOs are often the only option, given the limited number of buyers. A few successful IPOs could reignite M&A activity, as sellers will reinvest their proceeds."

5. Mega-deals

Bijschrift grafiek

The outlook on mega-deals, those valued at 1 billion euros or more, shows a cautious optimism within the M&A community, with 27 percent expecting an increase in these transactions. Niek Kolkman, Head of Deals at KPMG, suggests that this could be driven by the interest of large American private equity firms entering the European market, fueling the possibility of more high-value transactions. According to Peter Zwijnenburg of Aon, "after an absence of large deals, these will clearly return from Q2 2025."

This resurgence of mega-deals is also attributed to a strategic shift among corporates, combined with the abundant capital available in private equity, as noted by Dentons partners Kuif Klein Wassink and Ico Jalink. Despite this optimism, the landscape in Benelux remains more conservative. Lieke van der Velden, Managing Partner at NautaDutilh, points out that "deals over a billion euros are rare in the Benelux and are often strategic in nature", referencing notable exceptions of mega deals like the strategic a.s.r.-Aegon transaction that she worked on.

Adding to this, Joost den Engelsman, also of NautaDutilh, highlights the impending sale of DSM’s animal nutrition division, which could see fierce competition among foreign private equity firms and strategic buyers. “That will be a huge transaction, and I expect major foreign private equity firms, along with strategic buyers like Nutreco, to compete for it.” He notes that these transactions are too large for Dutch private equity firms, yet they offer hope for two or three significant deals each year. Meanwhile, the financial sector could see substantial movement, with the potential privatization of de Volksbank and speculation around ABN AMRO's future, sparking further activity in the market.

However, not everyone is convinced of an immediate surge. Marc Habermehl from Stibbe believes that specific strategic and more atypical large deals are happening and will continue, the multi-billion euro auction processes might not surface until after the year-end.

6. SPACs

SPACs (Special Purpose Acquisition Companies) have fallen out of favor in the Benelux. “SPACs have largely failed in the Netherlands”, says Tom Beltman, bluntly summarizing the sentiment shared by many experts.

Marc Habermehl of Stibbe adds: “The SPAC boom promised quicker, more efficient market entry, but in practice, they didn’t deliver."

Even as some SPACs continue to search for acquisition targets, the consensus is clear. As Niek Kolkman of KPMG puts it, “SPACs were all the hype, but their numbers are likely to dwindle further."

Hans Swinnen, Partner at 3d-investors, agrees: “As for SPACs, it feels like the hype has passed. I don’t see much news about them, and when I do, it’s not very positive. I’ve always found the concept strange – investing in an empty entity and waiting to see what’s placed in it. Will it be something valuable, or will it turn out to be worthless?”

“I’ve always found the SPAC concept strange – investing in an empty entity and waiting to see what’s placed in it. Will it be something valuable, or will it turn out to be worthless?”

Hans Swinnen, Partner at 3d-investors

Conclusion

While optimism surrounds general business acquisitions and distressed M&A, larger transactions like mega-deals and IPOs are expected to remain steady. SPACs, once a hot trend, are now largely dismissed by professionals as a fading phenomenon.